The protracted negotiations for the addition of Porsche to the Volkswagen Group stable have been completed and will take effect on 1 August, the two companies have announced. Plans for this move started in 2009 and Prof Dr Martin Winterkorn, Chairman of Volkswagen AG (pictured right), says the deal is, “good for Volkswagen, good for Porsche and good for Germany as an industrial location.”

New German tax laws have enabled the deal to be brought forward, after complications saw the original deadline for completion of the merger missed at the end of last year. Volkswagen will hand over one ordinary share to Porsche and assume total ownership of the holding company controlling the sportscar maker. In exchange Porsche will receive €4.46b.

At the press conference announcing the finalisation of the takeover Volkswagen’s CFO, Hans Dieter Pötsch, explained the benefits of the approach taken. “The course we are following makes strategic sense and will bring sustained benefits for all stakeholders, it creates transparency as to future developments, and lays the foundations for swiftly intensifying cooperation between Volkswagen and Porsche AG. For Volkswagen, our sound financial and liquidity position and maintaining our strong rating are also important”, he said.

With plans for massive investment Dr Winterkorn told reporters to expect big things. “We’re wrapping up one of the most significant projects in the automotive world,” Winterkorn said. “Together we are more capable than ever of becoming the best auto company on the planet.”

Volkswagen and Porsche create integrated automotive group

- Accelerated integration model permits combination of automotive business with expected effect as from August 1, 2012

- Porsche’s automotive business will be contributed in full to the Volkswagen Group ahead of schedule for around €4.46 billion plus one Volkswagen ordinary share

- Net synergies of approximately €320 million from the accelerated integration will be split 50:50 between the two companies

- CEO Prof. Dr. Martin Winterkorn: “Good for Volkswagen, good for Porsche and good for Germany as an industrial location”

Wolfsburg, July 04, 2012 – Volkswagen Aktiengesellschaft and Porsche Automobil Holding SE (Porsche SE) are to create the integrated automotive group through the contribution in full of Porsche’s automotive business to the Volkswagen Group, with the move expected to already take effect as of August 1, 2012. The relevant governing bodies of the two companies approved the plan for this today. The move will allow the integrated automotive group consisting of Volkswagen and Porsche to become reality some two years earlier than would have been economically feasible under the put/call options provided for in the Comprehensive Agreement signed in August 2009. Porsche SE will receive around €4.46 billion and one Volkswagen ordinary share as consideration for contributing the 50.1 percent of Porsche AG not yet owned by Volkswagen. “The unique Porsche brand will now become an integral part of the Volkswagen Group. That is good for Volkswagen, good for Porsche and good for Germany as an industrial location. Combining their operating business will make Volkswagen and Porsche even stronger – both financially and strategically – going forward. We can now cooperate even more closely and jointly leverage new growth opportunities in the high-margin premium segment through targeted investments in pioneering products and technologies. This will benefit our customers, our employees and our shareholders”, said Prof. Dr. Martin Winterkorn, Chairman of the Board of Management of Volkswagen Aktiengesellschaft.

The two companies announced last September that it would not be possible to implement the merger of Volkswagen AG and Porsche SE provided for in the Comprehensive Agreement signed in 2009 by the end of 2011, as had been agreed. In addition, the tax treatment of the put/call options provided for in the Comprehensive Agreement does not allow the automotive business to be integrated on economically feasible terms before the second half of 2014. The two companies have therefore been exploring alternative ways of achieving their common goal of an integrated automotive group that can be implemented by all parties at an earlier point in time.

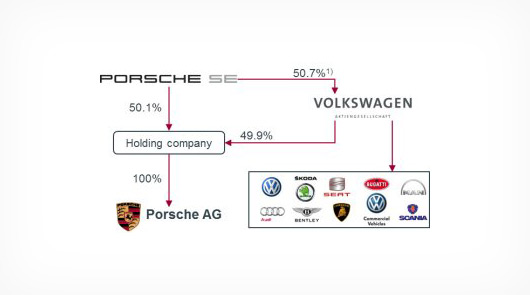

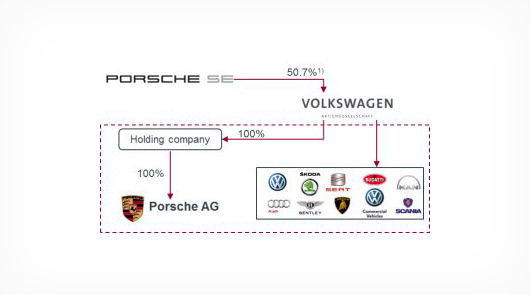

The accelerated integration model that has now been agreed is based on the Umwandlungssteuergesetz (Reorganization Tax Act) and the Umwandlungssteuererlass (Taxation of Reorganizations Circular) which was published at the end of 2011, as well as advance rulings from the relevant tax authorities, and can be implemented on economically feasible terms. Under the structure developed jointly by the two companies, Porsche SE will contribute its operations as a holding company, including its 50.1 percent Porsche stake, to Volkswagen Aktiengesellschaft, which already holds indirectly 49.9 percent of Porsche AG. Once the transaction has closed, Volkswagen will hold 100 percent of the shares of Porsche AG via an intermediate holding company. In return, Porsche SE will receive a consideration totaling around €4.46 billion plus one ordinary share of Volkswagen. The cash consideration is based on the equity value of €3.88 billion for the remaining shares of Porsche AG set out in the Comprehensive Agreement, plus a number of adjustment items. Among other things, Porsche SE will be remunerated for dividend payments from its indirect stake in Porsche AG that it would have received as well as for half of the present value of the net synergies realizable as a result of the accelerated integration, which amount to a total of approximately €320 million.

“The accelerated integration will allow us to start implementing a joint strategy for Porsche’s automotive business more quickly, to realize key joint projects more rapidly, and hence to leverage additional growth opportunities in attractive market segments. It will also enable Volkswagen AG and Porsche AG to concentrate fully on their operating business by making day-to-day cooperation much simpler”, said CFO Hans Dieter Pötsch.

The consolidation of Porsche’s highly profitable automotive business, which is expected to take effect as from August 1, 2012, will have a positive impact on Volkswagen’s consolidated profit. With regard to operating profit for the current fiscal year, the initial high depreciation and amortization charges resulting from the so-called purchase price allocation are expected to largely offset the earnings contribution. As a consequence of the consolidation of Porsche’s automotive business, Volkswagen must remeasure its existing shares in Porsche Zwischenholding GmbH at their fair value. For the current year, based on the measurement parameters as of March 31, 2012, this will result in a clearly positive noncash effect of more than €9 billion in the Volkswagen Group’s financial result. Net liquidity in the Automotive Division is expected to decline by a total of approximately €7 billion. Apart from the cash consideration of around €4.46 billion, the initial consolidation of Porsche AG’s negative net liquidity – expected to be around minus €2.5 billion – will impact liquidity at the Volkswagen Group.

“The course we are following makes strategic sense and will bring sustained benefits for all stakeholders, it creates transparency as to future developments, and lays the foundations for swiftly intensifying cooperation between Volkswagen and Porsche AG. For Volkswagen, our sound financial and liquidity position and maintaining our strong rating are also important”, CFO Pötsch continued.

Structure before the transaction

Structure after the transaction

Note: Schematic Overview

1) Ordinary shares

4 replies on “Volkswagen ready to takeover Porsche”

It’s €4.46b Lima, not million lol.

So Porsche SE is the majority shareholder of VW?

A quick check on Porsche SE’s website showed that a Porsche family member chairs this holding company, and supervisory board members included a Qatar royal family. From that I take it that the Porsche family and Qatar owns a large chunk of what we know as VAG then.

Oops, thanks Wayne, haha!

Fixed.

[…] reported early last month Volkswagen’s takeover of Porsche was due to take effect from 1 August. There’s been no […]